Throughout history certain metals have been critical for defense. During the Greek era, it was bronze. During the Roman Empire, it was iron. In the late 19th Century and early 20th Century, it was copper.

In fact, copper was so critical during the American Civil War that the Confederates sent agents to the Carolinas to confiscate copper turpentine and alcohol stills. It was critical for everything from cannon production to parts for the first operational submarine – the CSS Hunley.

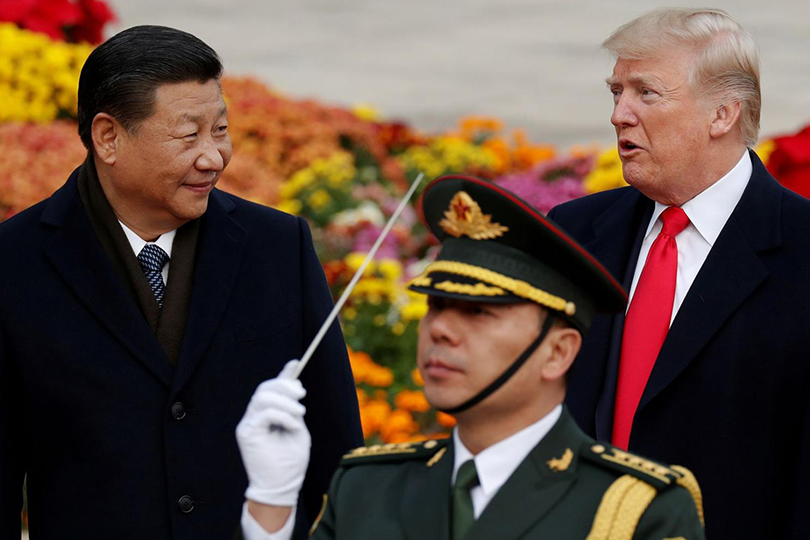

Today, it is rare earths that are considered strategic minerals. This is a dramatic change for a group of elements that were once considered merely chemical curiosities. China is threatening to use rare earths as a “nuclear” option in their growing trade riff with the US. China accounts for more than 70% of global output of rare earths and it has prepared a plan to restrict exports of rare earths to the US if the trade war continues.

This week, the Commerce Department released a report requested by President Trump to investigate US access to rare earths in an emergency.

The report said, “The United States is heavily dependent on critical mineral imports…If China or Russia were to stop exports to the United States and its allies for a prolonged period – similar to China’s rare earth embargo in 2010 – an extended supply disruption could cause significant shocks.”

Rare Earth Elements (REEs) are relatively unknown to the average person. Names like europium, praseodymium, neodymium, lanthanum, samarium, cerium and gadolinium rarely get mentioned in chemistry classes, much less normal conversation. Although called “Rare Earths,” they are abundant in the Earth’s crust. It was the fact that they were hard to extract and purify that led early scientists to think they were rare. Before World War Two, the world’s supply of many of these elements was measured in grams and merely laboratory curiosities. And, the lack of samples guaranteed that scientists didn’t spend much time studying their properties.

The growth in electronics in the post WW II age changed all that. Today REEs are critical for optics and electronics. Europium, for instance provides the red phosphor in color cathode-ray tubes and liquid crystal displays used in computers and televisions. There is no known substitute.

Rare earths aren’t just important for our cell phones, computers, and DVD players. They are increasingly important in America’s national defense, which leaves the Department of Defense concerned that the United States may not have enough rare earths to wage a war, especially if China cuts off our supplies.

U.S. military technologies such as anti-submarine warfare, smart bombs, and night vision rely heavily upon rare earth elements. But rebuilding an independent U.S. supply chain to protect the country from foreign dependency could take up to 10 years, according to a recent report by the U.S. Government Accountability Office (GAO). The GAO report was commissioned to look at national security risks that could arise from our dependency upon rare earth elements.

These are some of the military technologies that could be hurt with a rare earth embargo.

Rare earth elements are a critical part of devices such as lasers, radar, missile-guidance systems, satellites and aircraft electronics. And many military systems also rely upon commercial computer hard drives that use rare earth magnets. Specific examples of rare earth-driven technologies include the navigation system for the M-1 Abrams battle tank, and the electric drive for the Navy's DDG-51 destroyers. The GAO report states, "Defense systems will likely continue to depend on rare earth materials, based on their life cycles and lack of effective substitutes." The rare earth element neodymium, for instance, is very magnetic and is used in everything from computer hard drives to wind turbines and hybrid cars.

The U.S. once supplied most of the global supply of rare earth elements and manufactured rare earth products such as the neodymium magnets. But rare earth processing has largely shifted to China since the 1990s.

Fortunately for US, Mountain Pass, California is perhaps the largest non-Chinese rare earth deposit in the world. For years, the United States was self-sufficient in the mining of REE thanks to the Mountain Pass deposits which were discovered in the 1949. Two prospectors were looking for uranium deposits, when their Geiger counter detected high radioactivity in a rock outcropping. The prospectors staked a claim and sent off ore samples. When the assay results came back, they discovered that they had discovered a rare earth mineral called bastnaesite, which was worthless at the time.

Mountain Pass was developed at a critical time. By the 1960s color televisions were finding their way into every American household and europium was critical for their television tubes. As the mine developed more efficient solvent extraction processes to extract europium, they produced in turn more REEs, which allowed scientists to find new uses for them. Many of these new applications were in defense industries.

For the next generation, Mountain Pass was the major source for rare earths for the world. However, the increased demand for them caused geologists to find new deposits for them, especially in China, which soon became the major rare earth producer.

Today, Mountain Pass is the only rare earth mining and processing facility in the US. The mine is currently operating, but its output must be shipped to China for refining. However, the owner, MP Materials has said it will start its own refining operation in 2020.

Mountain Pass doesn’t supply all the rare earths that the Department of Defense needs. It doesn’t produce “heavy” rare earths like terbium and dysprosium. Dysprosium is used in the production of lasers, nuclear control rods, and hard discs. Terbium is used in solid state devices and as a stabilizer in fuel cells. Just as important for national security, it is also a component of Terfenol-D, which, expands or contracts in the presence of a magnetic field. This makes it critical for naval sonar systems.

Another rare earth deposit in Idaho - Diamond Creek - may solve some of the heavy rare earth shortage. Approximately 13 million metric tons of rare earth elements (REE) exist within known deposits in the United States, according to the first-ever nationwide estimate of these elements by the U.S. Geological Survey. The report describes significant deposits of REE in 14 states, with the largest known REE deposits at Mountain Pass, Calif.; Bokan Mountain, Alaska; and the Bear Lodge Mountains, Wyo. Additional states with known REE deposits include Colorado, Florida, Georgia, Illinois, Missouri, Nebraska, New Mexico, New York, North Carolina, and South Carolina

China is also investing in rare earth mining around the world (it also is a minority shareholder in MP Materials and at one time, it even tried to buy the Mountain Pass mine).

China Minmetals Group of China has financed Upland Wings, Inc. and Wings Enterprises, Inc., which owns rare earth deposits at Pea Ridge, Missouri. In 2009, the China Investment Corp bought a 17 percent stake in Teck Resources Ltd., which owns rare earth deposits in Iron Hills, Colorado.

Although other countries like France, Estonia, and Japan have REE deposits, much of their production is also sent to China as concentrates for refining.

One reason some consumer electronic production like cell phones is centered in China is because it makes it easier for the manufacturers to access the REEs they need.

But it isn’t just China’s attempt to corner the REE mining sector that is worrying the US. It has also focused on finding new applications for REEs and is now a rare earth technology leader. REEs are critical to several defense technologies and American military leaders are uncomfortable with China’s lead in this critical technology. Karl A. Gschneidner Jr., a senior metallurgist at the U.S. Department of Energy's Ames Laboratory, recently cautioned members of a Congressional panel that "rare-earth research in the USA on mineral extraction, rare-earth separation, processing of the oxides into metallic alloys and other useful forms, substitution, and recycling is virtually zero."

The REE Embargo Threat

So, what would happen if China restricted REE exports to the US? The first impact would be in consumer electronics, which would become more expensive or even difficult to acquire.

The US government has modest strategic reserves, which have been built up recently. The reserves include Dysprosium, Europium, and Yttrium Oxide. The FY 2019 budget provides for additional acquisitions, but the amount that will be purchased is currently unknown.

Although the US and other Western nations don’t have large official REE stockpiles, it is awash in out-of-date consumer products that can be recycled if the price is right. This occurred several years ago, when China raised prices on its REEs. Discounts on new cell phones for turning in old cell phones, would bring in the stock of obsolete or broken cell phones squirreled away in American consumer’s drawers. Those discounts would help offset the increased prices of new consumer electronics.

The American defense industry would be better protected against a REE embargo. Not only is there the US stockpile, the pipeline from REE mine to final defense product is long. The defense contractors could also outbid consumer producers for old consumer electronics. With the inevitable prioritizing of REE mining and refining by the government, by the time the US stockpiles start running out; domestic production would be ramping up.

In the end, since the US has large Rare Earth reserves in the ground, it would suffer less than many other nations.

Since the Chinese raised REE prices in 2010, the US has focused on boosting REE production and, on streamlining the permitting process for rare earth miners.

Since the US has vast rare earth mineral reserves, the only issue is building refining plants, which could be completed in a short time, because the US has rare earth refining technology (although it may be older than Chinese technology).

There is also the issue of sanction busting. Rare earths are easier to move around the world than products like petroleum, which Iran has little problem smuggling. The US could easily find sources of Chinese rare earths if necessary.

The Chinese threat to cut back on its exports is a two-edged weapon. China can temporarily cut its REE exports, which would raise prices and impact American consumer electronics production. It, however, will put a major pressure on American defense establishment to come up with alternative solutions to its military needs.

Comments