Here’s a dead-end job: Swedish bank robber. In 2016, there were only two bank heists in all of Sweden, compared with 110 eight years earlier. Why the steep plunge? The country’s bent on going cashless.

In 1661, Sweden became the first European country to print banknotes; several centuries later, it might become the first country to get rid of them. Card readers and mobile-payment apps are now used even in situations that were once reserved for dog-eared bills and pocket change, like donating in church. Buses in Sweden don’t accept cash. Neither do many street vendors.

Though the government is still printing Sweden’s national currency, the krona, two-thirds of Swedes say they feel that they could live without bills and coins. According to the Riksbank, Sweden’s central bank, cold hard kronor accounted for barely 2 percent of the value of all payments made in Sweden in 2015. The bank projects that “cash will stick around until the 2030s,” but not necessarily longer. Already, fewer than half of Swedish banks keep any on hand. Sweden also has the lowest rate of ATM withdrawals as a percentage of GDP in the world, at a measly 2.5 percent. The word is out among the brotherhood of muggers and pickpockets: In Sweden, crime doesn’t pay like it used to.

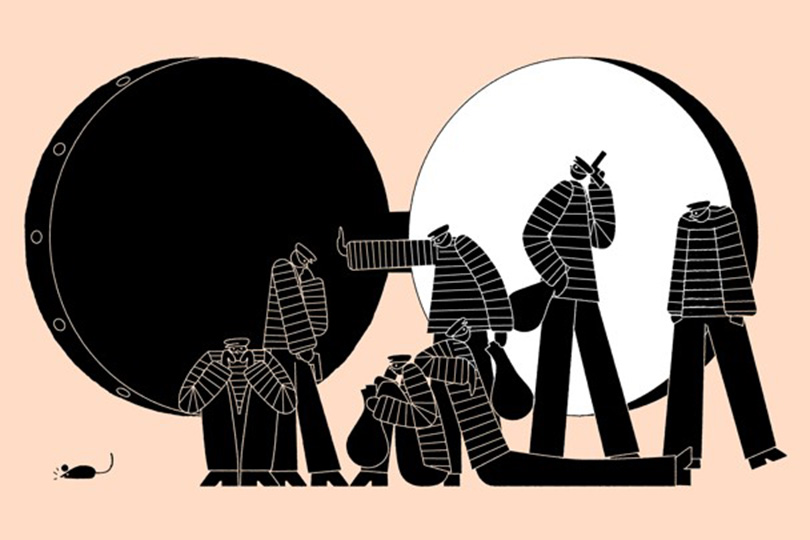

Which might be why Swedish thieves are embarking on ever more outlandish crimes, including a recent series of heists worthy of The Fast and the Furious. Imagine breaking into the back of a moving delivery truck by night and stealing tens of thousands of dollars’ worth of Apple products. Now imagine reaching for that truck from the hood of a car traveling 50 miles an hour, its lights off to avoid detection. After enduring several such attacks, the Swedish postal service, PostNord, busted the highway robbers by wiring a truck with cameras, filling it with Apple products, and waiting. On a road somewhere between Vara and Alingsås, in southwest Sweden, the robbers took the bait, and cops moved in. “Criminals are more interested in high-value goods now,” says Alexis Larsson, PostNord’s head of security and claims. “This trend will probably increase as less cash is available.”

Thieves may be emboldened by the fact that police are already stretched thin, thanks to surging burglaries and gang violence in Swedish cities. A recent string of smash-and-grabs in downtown Stockholm was particularly audacious. Early one morning last year, burglars rammed a Volvo construction vehicle through the front of a Chanel boutique in the posh Norrmalm district. Despite causing extensive damage, the Volvo was no match for the storefront’s protective bars; the perps eventually gave up and fled. Five months later, a gang drove a car through the entrance of a nearby luxury department store, and were reported to have made off with a haul.

As Sweden’s supply of banknotes continues to dwindle, criminals have shown new enthusiasm for the endangered-species black market, previously cornered by reptile wranglers and orchid thieves. Crimes involving protected species recently reached their highest level in a decade. A single great gray owl—known as the “phantom of the north”—now goes for 1 million kronor (about $120,000) on the dark web.

Crimes against people—assault, robbery, fraud—are also on the rise. The Swedish National Council for Crime Prevention found that in 2016, 15.6 percent of the country’s citizens fell prey to at least one such offense—the highest rate since the council launched its annual crime survey, 10 years before. According to The Guardian, electronic fraud is increasing at an especially rapid clip in Sweden, more than doubling in the past decade.

Of course, the shift from cash to digital currency was supposed to reduce crime. And in some ways, it has: Swedish bank robbers and light-fingered cashiers have gone the way of ABBA hit singles. But as paper money gets scarce, other types of crimes have flourished. Internet scams are especially popular with thieves and range from humdrum phishing expeditions (using emails to obtain valuable information like banking passwords) to more novel and clandestine hustles like “cryptojacking” (undetected use of computing power to mine virtual currencies).

Though it’s no small irony that going cashless might inspire more crime rather than less, it is, from one perspective, predictable. Research indicates that as we gain “psychological distance” from money, our willingness to steal increases. Which helps explain why so many people cheat on taxes, inflate insurance claims, and steal Post-it Notes from the office.

Or try to steal designer handbags via bulldozer.

Comments